staples tax exempt department

Enter your staples tax exempt customer number in the field provided and click continue. Department at 888-753-4103.

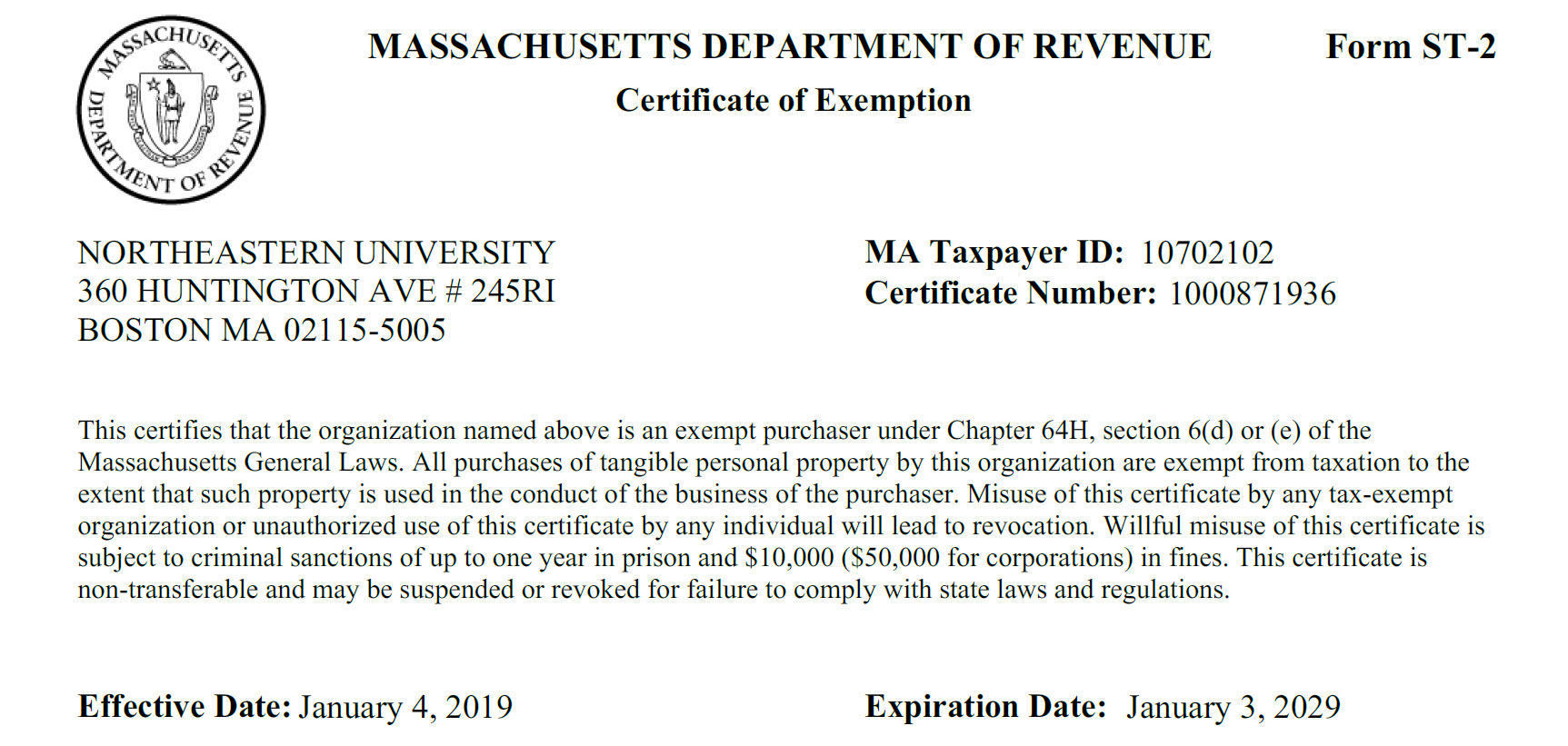

Forms Office Of Finance Northeastern University

If this number is not.

. December 31 2021. If discretionary funds are used departments may opt to pay for sales tax in lieu of. They will work on your behalf to remove negative items on your credit reports such.

Faxing it to us at 1-800-567-2260. Complete the Type of Business Section. Click Edit next to the Customer Number section.

STAPLES TAX has entered into a timely relationship with one of the leading credit repair agencies in the state. Tax-Exempt Correspondence If you need to send in a tax-exempt certiÞcate please reference your account number and email it to the tax-exempt group at. Rates in this table apply to employees exempt from minimum wage and overtime under the New York.

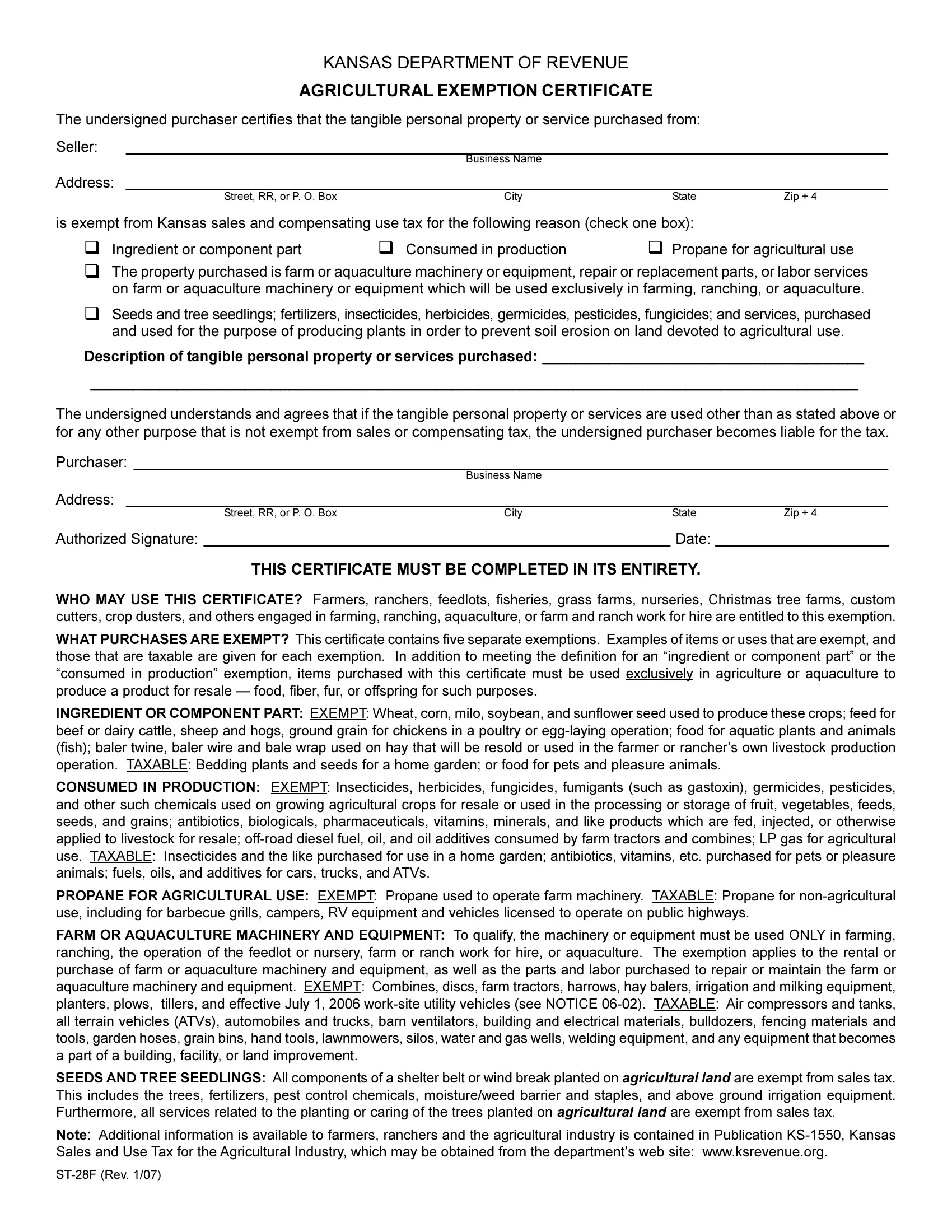

Give the completed form to the out-of-state seller at the time of purchase. Click My Account from the homepage. The site provides immediate access to over.

New York State Department of Taxation and Finance Taxpayer Services Division TSB-A-85 1S Sales Tax Technical Services Bureau April 5 1985 STATE OF NEW YORK. Applies to an institution that is currently exempt but is seeking to. STAPLES TAX EXEMPT NUMBER FOR COMMERCIAL CARD USERS Present this number before each purchase you make at Staples for University business purposes.

Dont file this form with us. To report non-filers please email. Present your card or number to the cashier at checkout.

Organizations tax-exempt status by handling all the IRS reporting for you. The out-of-state seller may accept this certificate as a substitute resale certificate. To report a criminal tax violation please call 251 344-4737.

When setting up tax exemption you will need to provide. Each year the IRS requires most tax-exempt organizations to submit the Form 990 and its relations which. Staples tax exempt department.

And select your particular state or contact the Oce Depot Tax Exempt Department. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic. Sales Tax Exempt Certificate - Staples.

All purchases made with a University p-card are exempt from North Carolina State sales tax. Under Personal Information click the View Now link.

Got Questions About Your Ohio Taxes Here Are Some Answers Cleveland Com

How To Make Tax Exempt Purchases In Retail And Online Stores How To Make Money On The Internet

Staples To Sell For 6 9 Billion And Its New Owner Has An Uphill Battle The New York Times

How To Get Sales Tax Exempt At Staples Amazon Fba Reselling Youtube

Staples Com Customer Service Order Support

Form St 28f Fill Out Printable Pdf Forms Online

Sales And Use Applying The Tax Department Of Taxation

Staples Heavy Duty Packing Tape Dispenser 2 Grip 523621 Walmart Com

How To Get Sales Tax Exempt At Staples Amazon Fba Reselling Youtube

News Flash Middletown Ri Civicengage

The List What Is And Isn T Tax Free During Sc S 72 Hour Tax Free Weekend Event

South Carolina Department Of Revenue Facebook

Does Anyone Else Have Trouble With Tax Exemption Every Time Or Is It Just Me R Staples

Amazon Com Freeman Pfs9 Pneumatic 9 Gauge 2 Fencing Stapler With Case Orange Fs9g175 9 Gauge 1 3 4 Barbed Fencing Staples 1000 Count Corrosion And Rust Resistant Everything Else

Staples Heavy Duty Packing Tape Dispenser 2 Grip 523621 Walmart Com